The conversation around sustainable investing has evolved rapidly in recent years, with digital platforms making it easier than ever to align financial portfolios with climate goals.

Among these platforms, CO2.Capital has been gaining attention in 2025 for its promise to simplify carbon-conscious investing.

But with the surge of new tools in this space, it’s important to separate genuine impact-driven platforms from those that simply leverage green branding.

In this CO2.Capital Review, we’ll take a closer look at what the platform actually offers, how it works, and whether it lives up to its claims.

From features and pricing to user experience and real-world impact, this guide provides a transparent analysis for anyone considering CO2.Capital as part of their sustainability journey.

As a sustainability professional and content writer, I approach this review with both a critical eye and a practical perspective.

You’ll find not just a breakdown of the technical features but also an honest discussion about who should — and shouldn’t — use this platform.

Whether you’re a retail investor curious about impact investing, a professional managing ESG portfolios, or simply someone looking to reduce the carbon footprint of your financial choices, this review will give you the clarity you need.

Let’s dive into the details of CO2.Capital to see if it deserves a place in your sustainable investment toolkit.

Table of Contents

ToggleCO2.Capital Features

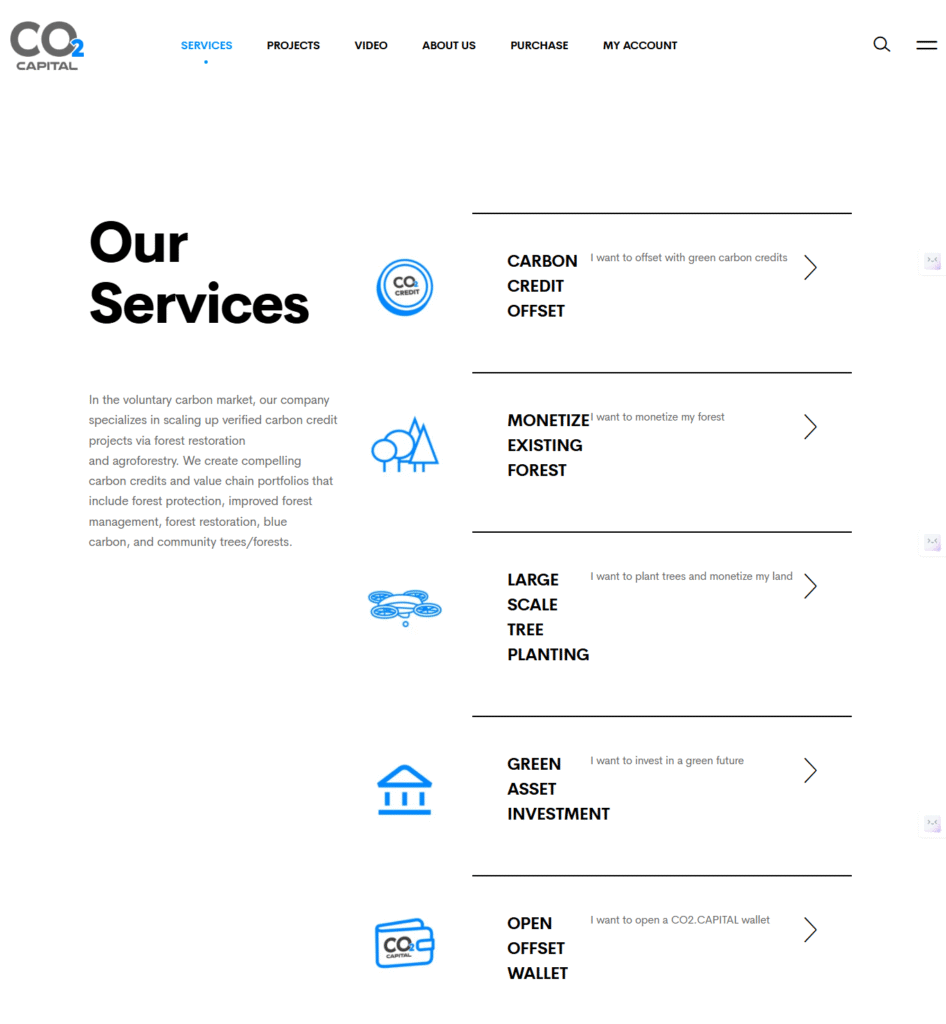

When evaluating a platform like CO2.Capital, the most important question is whether it goes beyond buzzwords and delivers tools that genuinely help investors align with sustainability goals. Below is a deep dive into its features, broken down by function and impact.

Portfolio Building Tools

CO2.Capital offers customizable portfolio-building options designed to prioritize climate-positive assets. Instead of forcing investors into pre-set “green funds,” it allows flexibility.

You can filter by carbon intensity, renewable energy allocation, or ESG ratings. This approach helps investors maintain control while staying aligned with climate goals.

A key strength is that the platform integrates both traditional equities and emerging green assets, including clean tech startups and verified carbon removal projects. The balance between accessibility and innovation sets it apart from platforms that only focus on mainstream ESG funds.

Carbon Footprint Tracking

A standout feature is the real-time carbon tracking dashboard. Unlike platforms that offer vague sustainability scores, CO2.Capital quantifies the carbon footprint of each portfolio holding. This is expressed in tons of CO₂ emissions avoided or offset per year.

Investors can see both positive contributions (renewables, carbon credits) and negative exposures (fossil-heavy holdings). The transparency makes it easier to adjust allocations. For users serious about impact investing, this feature provides clarity that’s often missing in ESG products.

If you want to track your investments in this way, you can check your portfolio impact with CO2.Capital.

Integration with Sustainable Assets

The platform doesn’t just stop at stocks or ETFs. It gives access to:

- Carbon credit projects verified by international standards.

- Clean energy bonds that fund solar, wind, and green infrastructure.

- Impact-driven startups screened for sustainability.

This broader asset coverage enables diversification without compromising on climate goals. Retail investors who previously found such investments inaccessible now have an entry point through CO2.Capital.

Transparency & Reporting Tools

CO2.Capital puts a strong emphasis on transparency. Users receive impact reports that show not just financial returns but also environmental outcomes. These reports include metrics such as:

- Tons of CO₂ avoided through portfolio allocation.

- Renewable energy generated by invested projects.

- Verified carbon offsets purchased.

This feature supports long-term accountability and allows investors to share their impact with stakeholders or communities.

User Experience

The platform is designed with simplicity in mind. The interface is clean, with guided onboarding that helps beginners navigate sustainable investing. Its mobile app mirrors the desktop version, ensuring consistency.

Notable highlights:

- Accessibility: Beginner-friendly with educational resources.

- Customization: Advanced filters for experienced investors.

- Ease of Use: Smooth transactions and portfolio rebalancing.

The only drawback is that some advanced reports are locked behind premium plans, which may frustrate free users. Still, the overall user experience feels polished and intuitive.

Pros and Cons

Pros:

- Real-time carbon footprint tracking

- Broad access to sustainable assets

- Transparent impact reporting

- Intuitive user interface

Cons:

- Premium features locked behind paywall

- Limited coverage in certain global market

- Advanced investors may find fewer high-risk opportunities

Sustainability Impact

One of the most compelling aspects of CO2.Capital is its measurable contribution to sustainability. The platform partners with certified organizations to validate projects, ensuring investments lead to genuine emissions reductions. Unlike many ESG funds criticized for greenwashing, CO2.Capital links your portfolio to tangible climate outcomes.

For example, a portion of fees goes directly into verified carbon removal initiatives. This means that even passive users contribute to climate solutions. For those seeking more active involvement, the platform highlights opportunities in renewable energy financing and clean-tech innovation.

If sustainable impact matters to you, CO2.Capital can help you invest in climate-positive assets.

Final Take on Features

Overall, CO2.Capital excels in combining accessibility with impact. The features cater to beginners and experienced investors alike, while its emphasis on transparency builds trust. The sustainability integration isn’t just marketing—it has measurable results. While some limitations exist, particularly around premium-only tools, the platform sets a strong standard for what modern climate-conscious investing should look like.

If you want to explore its functionality first-hand, get started with CO2.Capital today.

To illustrate how CO2.Capital’s features work in practice, consider this scenario:

A user invests $5,000 into a diversified sustainable portfolio through CO2.Capital. The portfolio includes:

- 40% renewable energy ETFs

- 30% clean technology startups

- 20% verified carbon credit projects

- 10% sustainable bonds

Within the first year, the platform’s reporting shows:

- 3.2 tons of CO₂ avoided by shifting away from fossil-intensive funds.

- 1.5 tons of CO₂ offset through direct carbon credit investments.

- Renewable energy output equivalent to powering 15 households for a month.

This case highlights the measurable sustainability outcomes that CO2.Capital tracks. Instead of abstract ESG scores, investors can see concrete figures that reflect the environmental impact of their money.

CO2.Capital Pricing & Plans

When considering any investment platform, pricing is just as important as features. CO2.Capital takes a tiered approach to access, balancing free tools with premium offerings for serious investors.

Free Plan

The free plan is designed for beginners who want to experiment without financial commitment. It includes:

- Portfolio creation with basic sustainable filters

- Real-time carbon tracking for up to three holdings

- Monthly sustainability reports

- Access to limited educational content

While functional, the free plan is best viewed as a trial. Its biggest drawback is the restriction on detailed analytics and advanced asset classes. Still, it’s a valuable starting point for those curious about climate-conscious investing.

If you’re just starting out, CO2.Capital has lots to offer in its free plan.

Premium Plans

CO2.Capital offers several premium tiers, structured around portfolio size and features.

- Starter Premium (around $9–$12/month):

- Unlimited portfolio tracking

- Access to verified carbon projects

- Advanced carbon footprint metrics

- Professional Premium (around $25–$30/month):

- In-depth ESG and climate impact analytics

- Priority access to clean-tech startup investments

- Quarterly detailed impact reports

- Expanded educational content

- Enterprise/Institutional Tier (custom pricing):

- Designed for financial advisors, funds, and organizations

- Bulk reporting tools for stakeholders

- Integration with existing ESG frameworks

- Dedicated account management

The premium plans unlock the true power of the platform. Features like verified carbon credit access and detailed reporting justify the price for anyone serious about long-term sustainability.

Hidden Fees and Costs

Unlike some competitors, CO2.Capital is transparent about fees. There are no hidden transaction charges, though certain premium features (like access to exclusive clean-tech projects) may require higher-tier plans.

Additionally, a small percentage of subscription fees is allocated directly to certified climate initiatives, ensuring that part of the cost creates measurable impact.

Comparison with Alternatives

- Traditional ESG Funds: Many ESG mutual funds or ETFs charge annual fees ranging from 0.3% to 1%. While accessible, they often lack direct carbon tracking or impact reporting.

- Robo-Advisors with ESG Options: Platforms like Betterment or Wealthfront offer ESG portfolios but rarely provide transparency on specific sustainability outcomes.

- Carbon Offset Platforms: Some apps let users offset emissions but don’t integrate with investment portfolios.

CO2.Capital stands out because it combines investing with measurable climate action. It’s more comprehensive than carbon-offset apps and more transparent than most ESG-focused robo-advisors.

For investors comparing options, the premium subscription is competitively priced given the level of detail and impact reporting.

Value for Money

For casual users, the free plan is a good entry point. But serious investors will quickly find themselves upgrading. The Professional Premium tier offers the best value, as it balances cost with access to exclusive assets and robust impact reporting.

If you’re weighing the options, explore CO2.Capital’s premium features to see which tier suits your goals.

| Plan/Platform | Monthly Cost | Key Features | Best For |

| CO2.Capital Free | $0 | Basic portfolio creation, 3-holding carbon tracking, monthly reports, limited learning tools | Beginners curious about sustainable investing |

| CO2.Capital Starter Premium | $9–$12 | Unlimited tracking, verified carbon projects, advanced footprint metrics | Retail investors wanting more impact data |

| CO2.Capital Professional Premium | $25–$30 | Deep ESG analytics, startup access, quarterly impact reports, expanded education | Serious investors and sustainability professionals |

| CO2.Capital Enterprise | Custom pricing | Institutional-grade reporting, ESG integration, dedicated account manager | Advisors, funds, and organizations |

| Traditional ESG Funds | 0.3%–1% annual fee | Generic ESG screening, limited transparency | Passive investors seeking simple exposure |

| Robo-Advisors (ESG option) | $10–$20 avg. monthly fee | Automated ESG portfolios, minimal transparency | Users prioritizing automation over impact |

| Carbon Offset Platforms | $5–$15 (per offset) | Standalone offsets, no investment integration | Individuals seeking direct carbon offsets |

Recommendation Note

- Free Plan → Best for newcomers testing sustainable investing.

- Starter Premium → Great for individuals who want deeper metrics without a big spend.

- Professional Premium → The sweet spot for most retail investors; balances cost with advanced features.

- Enterprise → Ideal for institutions and advisors managing multiple clients or stakeholders.

Compared to alternatives, CO2.Capital stands out for combining portfolio management, carbon tracking, and verified climate impact under one roof.

If you’re unsure where to begin, I started using CO2.Capital for sustainable investing, and the free trial made the upgrade decision much easier.

Honest Verdict

After exploring its features, pricing, and impact, it’s clear that CO2.Capital delivers more than just another ESG label. The platform stands out because it links investing decisions directly to measurable climate outcomes. Features like real-time carbon tracking and verified project access are not only rare but also meaningful in an era where greenwashing is widespread.

That said, the platform isn’t perfect. Its free plan, while useful as a trial, is too limited for anyone serious about impact investing. Some markets and asset classes are still underdeveloped, meaning advanced or global investors might feel restricted. In addition, professional reports and startup investment access are locked behind higher tiers, so cost can become a factor.

Overall, the value proposition is strongest for those who want to combine financial returns with clear, transparent sustainability data. It’s not just about feeling good—it’s about seeing tangible climate impact.

If you’re curious to test it yourself, explore CO2.Capital’s platform today.

Who Should Use CO2.Capital?

Best Suited For:

- Beginner investors who want a guided, transparent entry into sustainable investing.

- Retail investors looking to diversify beyond traditional ESG funds and see measurable results.

- Sustainability professionals who need credible impact reports for personal or stakeholder portfolios.

- Institutions/advisors seeking to integrate ESG reporting tools for clients or funds.

Less Suited For:

- High-risk investors focused on aggressive returns without sustainability goals.

- Traders who prioritize short-term profits over long-term impact.

- Users outside supported markets, where CO2.Capital has limited reach.

Future Outlook for CO2.Capital

Looking ahead, CO2.Capital has room to expand and innovate further. Based on industry trends and the platform’s trajectory, a few likely developments stand out:

- AI-driven climate risk analysis: Tools that predict how assets will perform under different climate scenarios could become part of future updates. This would help investors make even smarter, future-proof decisions.

- Global asset coverage: As the platform scales, expanding into emerging markets and international exchanges will make it more inclusive for global investors.

- Deeper integration with policy frameworks: Expect stronger alignment with international standards like the EU Taxonomy, Task Force on Climate-related Financial Disclosures (TCFD), and Science-Based Targets.

- Enhanced community features: Investors may gain opportunities to collaborate, share impact stories, or co-invest in verified climate projects.

If CO2.Capital follows this trajectory, it will not only remain relevant but could become a category leader in sustainable investing platforms. For now, it already sets a high bar, but the roadmap looks even more promising.

With its strong foundation and promising future, CO2.Capital is well-positioned to remain a leader in sustainable investing — making it a platform worth serious consideration.

Conclusion

Sustainable investing is no longer a niche trend; it’s becoming the standard for responsible financial decision-making. Platforms like CO2.Capital make this shift easier by combining portfolio management, carbon tracking, and verified impact reporting in one place.

From this CO2.Capital Review, we’ve seen that:

- Its features stand out with real-time carbon footprint tracking and access to climate-positive assets.

- Pricing is transparent and offers options for every type of investor, from beginners to institutions.

- The platform delivers measurable impact while maintaining user-friendly design.

- While not flawless, its strengths outweigh the drawbacks, especially for investors seeking both returns and responsibility.

In short, CO2.Capital bridges the gap between financial growth and environmental accountability — something many traditional ESG solutions still fail to do.

If you’ve been waiting for the right moment to align your investments with climate solutions, this is it. With flexible plans, transparent reporting, and a focus on genuine sustainability, CO2.Capital makes it easy to take action today.

Whether you’re just starting or looking to upgrade to professional-grade tools, sign up for CO2.Capital free trial and experience the difference first-hand.

I’ve personally seen how CO2.Capital can help you invest in climate-positive assets — and now it’s your turn to make your money work for both you and the planet.